Latest News Articles

Keeping you up to date with the latest Tax news.

Stay informed with our Monthly Newsletter

Sign up here:

CATEGORIES

- (47)Accounting & Financial Reporting

- (1)Accounting for Income Tax

- (1)Application of tax rates, s6(2) rebates

- (1)Assessed losses

- (10)Blogs

- (1)Business Advisory

- (8)Capital Gains Tax

- (1)Capital Gains Tax - Individuals Tax

- (1)Capital Gains Tax Implications of Trusts

- (2)Case study: Home office expense

- (1)Case study: Travel allowances

- (1)Company Formations

- (136)Corporate Tax

- (10)Customs and Excise

- (2)Deceased Estate

- (1)Deductions Pre-trade and prepaid expenses

- (1)Deregistration

- (2)Employer and Employee (PAYE and UIF Specific)

- (1)Estate Duty

- (1)Events / Webinars

- (11)Faculty News

- (2)Farming

- (168)Individuals Tax

- (1)Input - Customs Duty

- (3)Interest

- (18)International Tax

- (1)Nature of the rights of beneficiaries

- (1)Notional input tax

- (9)Payroll

- (2)Practical Payroll

- (2)Provisional tax (Link with other Taxes)

- (4)SARS Issues

- (156)Tax Administration

- (2)Tax Administration Part 2B: Resolving Problems with SARS using the Tax Ombud

- (1)Tax Administration Part 3B Dispute Resolution - Objection and appeal

- (3)Tax Dispute Resolution

- (1)Tax Opinions

- (3)Tax Update

- (1)Tax implications of loans to trusts

- (1)Tax residence

- (1)Tax returns and payments

- (3)Transfer-Pricing

- (1)Trust Income / Gain Allocations

- (1)Trust types and income allocations

- (10)Trusts

- (84)VAT

- (3)VAT periods

- (1)Wear and tear allowances

- (13)Wills, Estates & Succession

- (1)Zero Rated

- (2)eFiling

- Show All

Latest News

The Power of Continuous Tax Education for South Af...

- 25 February 2026

- Individuals Tax

In the ever-evolving world of taxation, continuous education is crucial for accountants and tax prac...

Read More

From Zero to Tax Hero: Understanding the Basics of...

- 21 February 2026

- Individuals Tax

This guide will simplify taxation basics, equipping you with a strong foundation to confidently begi...

Read More

Are You Confident That You Will Survive a SARS VAT...

- 16 February 2026

- VAT

A practical look at preparing for a SARS VAT audit, avoiding common pitfalls, and managing disputes...

Read More

The Request for Reasons: A Critical Gateway in Tax...

- 09 February 2026

- Tax Administration

Why the Request for Reasons matters in tax disputes — and how Rule 31(3) limits SARS during appeals.

Read More

Why SARS and CIPC compliance still feels hard — an...

- 06 February 2026

- Tax Administration

SARS and CIPC compliance doesn’t have to be reactive. This session explores how structured workflows...

Read More

Mastering Tax Court Rules Before Litigation: Your...

- 05 February 2026

- Tax Administration

Turn compliance into strategy. Gain the knowledge that gives you—and your clients—the advantage.

Read More

VAT Apportionment in South Africa: A Practitioner'...

- 21 January 2026

- VAT

A comprehensive overview of the standard turnover-based method, exclusions, and adjustments under Bi...

Read More

Provisional Tax: Practical Guidance to Avoid Penal...

- 14 January 2026

- Individuals Tax

This article unpacks provisional tax, who it applies to, and why reasonable estimates are key to avo...

Read More

Apportionment – A new dawn

- 11 December 2025

- VAT

This article outlines the key changes in VAT BGR 16 (Issue 3), including updated apportionment rules...

Read More

Top Tax Trends to Watch in 2026: A Guide for South...

- 03 December 2025

- Blogs

This article is a guide for South African tax students and discusses the top tax trends to keep an e...

Read More

Record Keeping: Focusing on the Tax Administration...

- 13 November 2025

- Tax Administration

This article explains key record-keeping duties under the Tax Administration Act, including who must...

Read More

The Burden of Proof: An Essential Guide to SARS Ve...

- 27 November 2025

- Tax Administration

A practical guide explaining the burden of proof in SARS verifications, highlighting how taxpayers c...

Read More

The Arm’s Length Principle: Foundation of Transfer...

- 27 November 2025

- Transfer-Pricing

This article explains the arm’s length principle, the foundation of South Africa’s transfer pricing...

Read More

Navigating the enhanced section 11D R&D incentive

- 21 October 2025

- Corporate Tax

The Section 11D R&D tax incentive, outlining recent legislative changes, eligibility criteria, quali...

Read More

The importance of detailed grounds of objection

- 20 October 2025

- Tax Administration

“Getting your objection right could be the difference between winning or losing a tax dispute with S...

Read More

Navigating Tax Court Litigation: A Strategic Imper...

- 13 October 2025

- Tax Administration

As SARS enforcement intensifies, tax practitioners must master Tax Court litigation to protect clien...

Read More

VAT Apportionment: Revised ruling

- 29 September 2025

- VAT

VAT vendors can only claim input tax for taxable use. BGR16 sets the default ratio (updated from Jan...

Read More

The timing conundrum of the suspension of payment...

- 10 September 2025

- Tax Administration

This article explores the pay-now-argue-later rule, the challenges of suspension requests, and the n...

Read More

The Journey of SARS Tax Return Automation and Tax...

- 22 September 2025

- Tax Administration

From brown envelopes in the 1990s to today’s auto-assessments and real-time VAT discussions, SARS ha...

Read More

Estimated Assessments: From Exception To Cash-Cow...

- 20 August 2025

- Tax Administration

This article looks at SARS’s use of estimated assessments under section 95 and the concern that they...

Read More

Medtronic as a matter of interest

- 15 August 2025

- Tax Administration

The purpose of the Voluntary Disclosure Programme (VDP)

Read More

What is the SAICA Accounting Technician SA (AT(SA)...

- 07 August 2025

- Faculty News

The SAICA AT(SA) designation certifies accounting technicians holding the Certificate in Accounting...

Read More

Vehicle Fringe Benefits in a CC: South African Tax...

- 21 July 2025

- Corporate Tax

Two Close Corporation (CC) members use vehicles registered in the CC’s name solely for private purpo...

Read More

Can a Sole Proprietor Claim Depreciation on a Rent...

- 26 July 2025

- Individuals Tax

A sole proprietor renting a standard residential property cannot claim depreciation on the building...

Read More

Individuals Tax News

The Power of Continuous Tax Education for South Af...

- 25 February 2026

- Individuals Tax

In the ever-evolving world of taxation, continuous education is crucial for accountants and tax prac...

Read More

From Zero to Tax Hero: Understanding the Basics of...

- 21 February 2026

- Individuals Tax

This guide will simplify taxation basics, equipping you with a strong foundation to confidently begi...

Read More

Provisional Tax: Practical Guidance to Avoid Penal...

- 14 January 2026

- Individuals Tax

This article unpacks provisional tax, who it applies to, and why reasonable estimates are key to avo...

Read More

Corporate Tax News

Navigating the enhanced section 11D R&D incentive

- 21 October 2025

- Corporate Tax

The Section 11D R&D tax incentive, outlining recent legislative changes, eligibility criteria, quali...

Read More

Vehicle Fringe Benefits in a CC: South African Tax...

- 21 July 2025

- Corporate Tax

Two Close Corporation (CC) members use vehicles registered in the CC’s name solely for private purpo...

Read More

Deferred Tax: The Quiet Complexity Lurking in Fina...

- 16 July 2025

- Corporate Tax

Deferred tax is more than an accounting issue—it impacts financial clarity and tax compliance. This...

Read More

VAT periods News

Getting out what you put in…A recap on the deducti...

- 19 December 2019

- VAT periods

Author: Varusha Moodaley

Read More

Further clarification on the VAT registration of n...

- 19 December 2019

- VAT periods

Author: Jerome Brink

Read More

Contingency Fees: VAT inclusive or exclusive?

- 27 May 2021

- VAT periods

Author: Gerhard Badenhorst

Read More

Tax returns and payments News

Weekly transfer pricing roundup – 19 June 2017

- 19 June 2017

- Tax returns and payments

Author: Marcus

Read More

Deregistration News

Deregistration as a VAT Vendor

- 27 May 2020

- Deregistration

A sole proprietor performs services for clients abroad. More than 90% of the taxpayer’s revenue is d...

Read More

Zero Rated News

[FAQ] Is the sale of borehole water a zero-rated s...

- 03 August 2020

- Zero Rated

Client “A” is a farmer who is a registered VAT vendor. His neighbour (Client “B”) is a poultry farme...

Read More

Notional input tax News

Value-added tax & transfer duty: Clarity or confus...

- 22 June 2020

- Notional input tax

Where fixed property is purchased by a VAT vendor from a non-vendor, transfer duty is payable thereo...

Read More

Input - Customs Duty News

VAT on imported services payable by non-registered...

- 05 June 2020

- Input - Customs Duty

On 1 June 2020, the South African Revenue Service (SARS) issued an external guide titled ‘Manage Dec...

Read More

Farming News

Welcome clarity on the taxation of farmers in Sout...

- 07 October 2022

- Farming

Welcome clarity on the taxation of farmers in South Africa?

Read More

Farmers claiming diesel rebate

- 17 February 2020

- Farming

The Supreme Court of Appeal recently overturned a decision by the High Court. The impact of the deci...

Read More

Capital Gains Tax - Individuals Tax News

[FAQ] The tax implication when cryptocurrency is s...

- 23 April 2021

- Capital Gains Tax - Individuals Tax

It is stated that income on cryptocurrency that was mined will be taxed when income is received/accr...

Read More

Practical Payroll News

Payment holiday for Skills Development Levy contri...

- 26 June 2020

- Practical Payroll

The COVID-19 outbreak together with extended lockdown continues to have a negative impact on the cas...

Read More

[FAQ] EMP501 Reconciliations

- 12 June 2020

- Practical Payroll

The taxpayer works as a tax practitioner at a company where they submit between 150 to 200 EMP501 re...

Read More

Employer and Employee (PAYE and UIF Specific) News

Employees’ Tax

- 22 March 2022

- Employer and Employee (PAYE and UIF Specific)

The Guide for Employers in respect of Employees Tax for 2023 has been updated to include the new tab...

Read More

[FAQ] Should benefits received from the South Afri...

- 17 November 2020

- Employer and Employee (PAYE and UIF Specific)

Should benefits received from SAFT be included or excluded from the IRP5 and will these benefits rec...

Read More

Application of tax rates, s6(2) rebates News

[FAQ] Rebates in the year a taxpayer ceases to be...

- 02 November 2020

- Application of tax rates, s6(2) rebates

A taxpayer ceased to be a resident in South Africa and it came to his attention that SARS allows the...

Read More

International Tax News

Navigating Withholding Tax on Cross-Border Service...

- 16 July 2025

- International Tax

Guidance for South African service providers on claiming withholding tax relief for cross-border tra...

Read More

Seafarer Tax Exemption: Navigating Section 10(1)(o...

- 01 June 2025

- International Tax

A brief analysis of whether South Africans working on yachts abroad qualify for the seafarer tax exe...

Read More

Tax Considerations for South African Companies Act...

- 11 June 2025

- International Tax

An overview of the tax, exchange control, and legal risks when a South African company acts as an Em...

Read More

Tax Administration News

The Request for Reasons: A Critical Gateway in Tax...

- 09 February 2026

- Tax Administration

Why the Request for Reasons matters in tax disputes — and how Rule 31(3) limits SARS during appeals.

Read More

Why SARS and CIPC compliance still feels hard — an...

- 06 February 2026

- Tax Administration

SARS and CIPC compliance doesn’t have to be reactive. This session explores how structured workflows...

Read More

Mastering Tax Court Rules Before Litigation: Your...

- 05 February 2026

- Tax Administration

Turn compliance into strategy. Gain the knowledge that gives you—and your clients—the advantage.

Read More

VAT News

Are You Confident That You Will Survive a SARS VAT...

- 16 February 2026

- VAT

A practical look at preparing for a SARS VAT audit, avoiding common pitfalls, and managing disputes...

Read More

VAT Apportionment in South Africa: A Practitioner'...

- 21 January 2026

- VAT

A comprehensive overview of the standard turnover-based method, exclusions, and adjustments under Bi...

Read More

Apportionment – A new dawn

- 11 December 2025

- VAT

This article outlines the key changes in VAT BGR 16 (Issue 3), including updated apportionment rules...

Read More

Payroll News

Payroll Considerations Managing New Employee Costs

- 09 July 2024

- Payroll

A client hired a new employee with a monthly cost to the company of R20000, without specifying if co...

Read More

[FAQ] Retrospective application for a severance ta...

- 29 July 2021

- Payroll

An employee received a lump sum when he left which was seen as a bonus payment. The employee left du...

Read More

[FAQ] Employment Tax Incentive and connected perso...

- 23 June 2021

- Payroll

Would a taxpayer be eligible to register his son under the business ETI or is he considered to be a...

Read More

Transfer-Pricing News

The Arm’s Length Principle: Foundation of Transfer...

- 27 November 2025

- Transfer-Pricing

This article explains the arm’s length principle, the foundation of South Africa’s transfer pricing...

Read More

Transfer Pricing in South Africa: An Arm’s Length...

- 20 September 2024

- Transfer-Pricing

straightforward and consistent with established transfer pricing principles. The court sharply criti...

Read More

Transfer Pricing has Finally Washed up on South Af...

- 25 March 2024

- Transfer-Pricing

With increasing economic globalisation, revenue authorities around the world continue to shift their...

Read More

Wills, Estates & Succession News

Estate Duty Planning: Utilising the General Deduct...

- 15 July 2025

- Wills, Estates & Succession

Overview of estate duty deductions and how a surviving spouse can use an unused basic amount from th...

Read More

Navigating Tax Consequences for Family Trusts: Int...

- 18 June 2025

- Wills, Estates & Succession

A brief analysis of tax issues in South African family trusts, covering interest income, trustee wit...

Read More

Cross-Border Inheritances and Historical Emigratio...

- 02 June 2025

- Wills, Estates & Succession

A brief guide on tax and exchange control rules for South African expatriates receiving inheritances...

Read More

Customs and Excise News

VAT Implications of Exporter of Record Designation...

- 14 April 2025

- Customs and Excise

This article analyses the correct designation of the Exporter of Record on the SAD500 form for indir...

Read More

Customs and Excise Act: Rule amendment notice R189...

- 06 April 2022

- Customs and Excise

The notice, as published in Government Gazette 46056, relates to the amendments to the rules publish...

Read More

Customs: Prohibited and restricted goods list

- 06 April 2022

- Customs and Excise

Customs: Prohibited and restricted goods list

Read More

Tax Update News

IT3(d) Third Party Data FAQs

- 28 May 2024

- Tax Update

IT3(d) onboarding, testing and live submissions will remain open for the duration of the submission...

Read More

2022 MTBPS: Generally good news, limited tax chang...

- 01 November 2022

- Tax Update

2022 MTBPS: Generally good news, limited tax changes

Read More

The 2020 Tax Amendments

- 17 December 2020

- Tax Update

The National Treasury recently published a number of bills that contain the amendments to the tax la...

Read More

Tax Opinions News

Bad Debt Deductions for Bodies Corporate: Income T...

- 15 July 2025

- Tax Opinions

A brief analysis of when bad debts are tax-deductible for a body corporate, based on exempt vs taxab...

Read More

Tax Dispute Resolution News

Yes, You Really Can Mess Up A SARS Objection

- 07 February 2025

- Tax Dispute Resolution

The Western Cape Tax Court case DR X and Dr X Inc v CSARS highlights the problem of vague and unsupp...

Read More

Revenue Augmentation: Low Hanging Fruit

- 14 June 2024

- Tax Dispute Resolution

In an apparent effort to win the war against non-compliance, it seems SARS has taken to augmenting t...

Read More

Dispute resolution - Is it time to settle?

- 12 August 2020

- Tax Dispute Resolution

The settlement of a tax dispute is available to taxpayers in respect of which an assessment has been...

Read More

Interest News

General rules regarding interest deductibility

- 17 August 2020

- Interest

In the current environment where there is a huge amount of debt being incurred by taxpayers it is us...

Read More

BGR 53 - Rules for the taxation of interest payabl...

- 22 June 2020

- Interest

This BGR sets out the rules to avoid double taxation when a deemed accrual of interest occurs under...

Read More

Updated Table of interest rates: Table 3 – Rates a...

- 27 January 2020

- Interest

Where a loan is obtained by an employee from his or her employer in terms of which no interest is pa...

Read More

Deductions Pre-trade and prepaid expenses News

Did the SCA get this right?

- 06 July 2020

- Deductions Pre-trade and prepaid expenses

Section 23H of the Income Tax Act is a provision that is designed to spread prepayments made by taxp...

Read More

Assessed losses News

Proposed changes to Assessed loss provision

- 15 September 2021

- Assessed losses

The 2021 Draft Laws Amendment Bill that was released in July 2021, has proposals to change section 2...

Read More

Wear and tear allowances News

BGR 7 - Wear-and-tear or depreciation allowance

- 15 February 2021

- Wear and tear allowances

This BGR reproduces the parts of Interpretation Note 47 (Issue 5) “Wear-and-Tear or Depreciation All...

Read More

Capital Gains Tax News

Sale of Share Options on Resignation

- 12 January 2024

- Capital Gains Tax

Payout classification for employees leaving after receiving company shares depends on factors like a...

Read More

[FAQ] The tax implication when shares are sold for...

- 26 August 2021

- Capital Gains Tax

A Trust owns 100% of the ordinary shares in a company and charges R20 million to a potential purchas...

Read More

[FAQ] Capital Gains Tax on the sale of shares wher...

- 12 August 2021

- Capital Gains Tax

A taxpayer is a director who wants to sell her shares to the remaining directors. The shares have a...

Read More

Trust types and income allocations News

Guide to the Taxation of Special Trusts (Issue 3)

- 10 September 2020

- Trust types and income allocations

The purpose of this guide is to assist users in gaining a more in-depth understanding of the taxatio...

Read More

Trust Income / Gain Allocations News

BPR 350 – Vesting of a capital gain in a trust ben...

- 14 September 2020

- Trust Income / Gain Allocations

This ruling determines the tax consequences of the vesting of a capital gain in a beneficiary, where...

Read More

Nature of the rights of beneficiaries News

The tax implications of medical expenses paid by a...

- 21 May 2020

- Nature of the rights of beneficiaries

The trust, special trust or otherwise, cannot make a deduction of the medical expenditure incurred o...

Read More

Tax implications of loans to trusts News

Amendment to section 7C: Beware of preference divi...

- 19 November 2020

- Tax implications of loans to trusts

With the introduction of section 7C, the interest saving arising on interest-free or low interest ra...

Read More

Capital Gains Tax Implications of Trusts News

Tax implications of terminating a trust

- 19 October 2020

- Capital Gains Tax Implications of Trusts

A trust is terminated by the Master after all the trust property was vested and distributed to the b...

Read More

Provisional tax (Link with other Taxes) News

[FAQ] How do you submit a Third Prov Tax return an...

- 22 August 2023

- Provisional tax (Link with other Taxes)

[FAQ] How do you submit a Third Prov Tax return and what penalties are payable if any?

Read More

[FAQ] Provisional tax when the financial year-end...

- 19 August 2021

- Provisional tax (Link with other Taxes)

A company changed its financial year-end from February to June. The change was made on 13 March 2021...

Read More

Deceased Estate News

How should a Deceased Estate be administered?

- 20 August 2020

- Deceased Estate

The administration of a deceased estate entails a regulatory process overseen by the Master of the H...

Read More

Estate Duty News

Company Formations News

BGR 54 - Unbundling of unlisted company: Impact of...

- 22 June 2020

- Company Formations

This BGR provides clarity on what constitutes an unbundling transaction when an unbundling company h...

Read More

Tax residence News

New proposal for required documents when ceasing t...

- 30 September 2021

- Tax residence

There has been a proposal that has been issued with new document requirements for taxpayers who wish...

Read More

Accounting for Income Tax News

Base Cost For Shares

- 16 February 2024

- Accounting for Income Tax

A trust adjusts share values annually but base cost remains R500 despite fair value changes under th...

Read More

Tax Administration Part 2B: Resolving Problems with SARS using the Tax Ombud News

[FAQ] What remedies are available to a taxpayer as...

- 24 July 2020

- Tax Administration Part 2B: Resolving Problems with SARS using the Tax Ombud

A taxpayer has lodged and objection with SARS. The objection was accepted, but SARS did not comply w...

Read More

[FAQ] Can the Tax Ombud assist with issues regardi...

- 22 July 2020

- Tax Administration Part 2B: Resolving Problems with SARS using the Tax Ombud

VAT returns submitted and paid through eFiling reflect on the taxpayer's work page. However, the ret...

Read More

Trusts News

Capital Gains Tax Risks for Trusts: The Dangers of...

- 10 June 2025

- Trusts

An analysis of the tax risks trusts face when relying on incorrect IT3(c) base costs, highlighting c...

Read More

Tax Treatment of Rental Income Distribution via Tr...

- 17 May 2025

- Trusts

The question examines the South African tax implications of distributing rental income through a tru...

Read More

S7C Implications – Loan Interest Calculation

- 26 February 2025

- Trusts

Determining whether loan interest under Section 7C should be calculated for the full financial year...

Read More

Accounting & Financial Reporting News

Tax Implications of Legal Fees Incurred as Part o...

- 07 April 2025

- Accounting & Financial Reporting

A brief analysis of the tax treatment of legal fees within management services, focusing on deductib...

Read More

Clarification on VAT and Tax Implications of Lease...

- 31 January 2025

- Accounting & Financial Reporting

Analysis of VAT and tax implications of lease agreements in South Africa, focusing on demand letters...

Read More

Blow to SARS

- 07 February 2025

- Accounting & Financial Reporting

Recently, a landmark victory was achieved against SARS in the tax court, which sets a significant pr...

Read More

Events / Webinars News

ChatGPT and AI for Accountants

- 03 May 2024

- Events / Webinars

ChatGPT – it’s the latest buzzword, and for good reason. This powerful new tool has the potential to...

Read More

Tax Administration Part 3B Dispute Resolution - Objection and appeal News

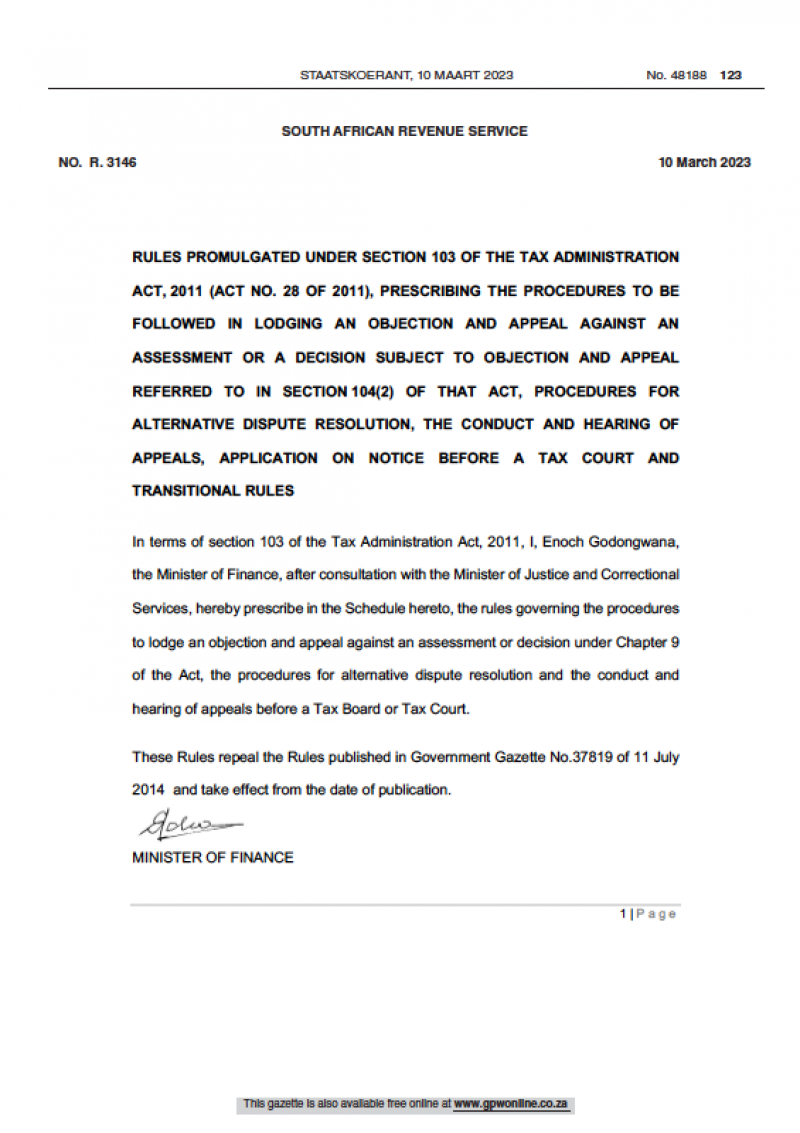

New Tax Dispute Resolution Rules (Effective 10 Mar...

- 11 March 2023

- Tax Administration Part 3B Dispute Resolution - Objection and appeal

The Minister of Finance approved new dispute resolution rules under the Tax Administration Act, 2011...

Read More

Case study: Travel allowances News

[FAQ] What is the correct tax treatment of employe...

- 28 August 2023

- Case study: Travel allowances

[FAQ] What is the correct tax treatment of employee travel allowances?

Read More

Case study: Home office expense News

[FAQ] Home office expense regarding solar installa...

- 22 August 2023

- Case study: Home office expense

[FAQ] Home office expense regarding solar installation

Read More

[FAQ] Home office expenses

- 21 October 2020

- Case study: Home office expense

A company has staff that have been working from home during COVID19. In total, there are 3 working d...

Read More

Faculty News News

What is the SAICA Accounting Technician SA (AT(SA)...

- 07 August 2025

- Faculty News

The SAICA AT(SA) designation certifies accounting technicians holding the Certificate in Accounting...

Read More

Big Tax Hikes Coming for Businesses in South Afric...

- 04 December 2024

- Faculty News

Carbon taxes in South Africa are set to rise by over 140% by 2030.

Read More

The Tax Faculty Accredited by SAICA to Offer Accou...

- 10 June 2024

- Faculty News

The South African Institute of Chartered Accountants on Monday 3 June 2024 announced the accreditati...

Read More

Blogs News

Top Tax Trends to Watch in 2026: A Guide for South...

- 03 December 2025

- Blogs

This article is a guide for South African tax students and discusses the top tax trends to keep an e...

Read More

Streamlining Payroll and Administration: A Compreh...

- 13 June 2023

- Blogs

Master payroll and administration for smooth operations. Discover best practices and tools to stream...

Read More

Why should you personalise your tax practice?

- 27 September 2022

- Blogs

In this article, we'll show you why personalisation is so important and how you can start incorporat...

Read More

SARS Issues News

SARS Giveth and SARS Taketh Away

- 25 March 2024

- SARS Issues

The alarmingly high unemployment rate in South Africa has given rise to several tax incentives for e...

Read More

SARS and Tax Court Closing Dates

- 08 January 2024

- SARS Issues

SARS excludes December 16th to January 15th from "business days" as per TAA Section 1, impacting the...

Read More

SARS Clarifying Trust Income Tax Return Requiremen...

- 31 August 2023

- SARS Issues

The purpose of this notice is to address these common issues, which may have been communicated durin...

Read More

eFiling News

Navigating eFiling: Operational and Processing Ess...

- 30 July 2025

- eFiling

This article outlines essential steps for navigating SARS eFiling during the 2025 Filing Season, inc...

Read More

eFiling Taxpayer Profile Hijackings on the Increas...

- 11 June 2024

- eFiling

You can be held liable for whatever a hacker manages to siphon from Sars in your name.

Read More

Business Advisory News

Address Unforeseen Threats Undermining Business St...

- 13 September 2024

- Business Advisory

Risk is an inherent part of running any business, yet many business owners overlook the importance...

Read More