Login to my Account

Quick Registration

Upskill With Our Future-Proof Tax Offerings

Popular Courses

Occupational Certificate Tax Professional (NQF 8) Full Programme

Duration 30 Months

R51 975

Occupational Certificate Tax Professional (NQF 8) Accelerator Programme

Duration 24 Months

R51 975

Occupational Certificate Tax Technician (NQF 6) Accelerator Programme

Duration 24 Months

R41 475

Occupational Certificate Tax Technician (NQF 6) Full Programme

Duration 30 Months

R41 475

Professional Certificate in Estate and Trust Administration

Duration 7 Months

R23 048

Professional Certificate in Tax Dispute Resolution

Duration 8 Months

R25 148

Professional Certificate in Payroll Taxes and Administration

Duration 6 Months

R15 698

Professional Certificate in Value-Added Tax

Duration 4 Months

R9 398

Professional Certificate in Accounting for Tax in Financial Statements

Duration 4 Months

R9 398

Professional Certificate in Tax Advisory and Opinion Writing

Duration 4 Months

R23 048

Advanced Professional Certificate in Taxation of Corporates

Duration 6 Months

R14 648

Professional Certificate in Taxation

Duration 12 Months

R27 248

Professional Certificate in Taxation of Individuals

Duration 6 Months

R14 648

Professional Certificate in Corporate Taxation

Duration 6 Months

R14 648

Advanced Professional Certificate in Taxation

Duration 12 Months

R28 298

Professional Certificate in International Taxation

Duration 6 Months

R25 725

Professional Certificate in Transfer Pricing

Duration 6 Months

R25 725

Short Course in the Fundamentals of Corporate Income Tax

R3 950

Read More about a Short Course in the Fundamentals of Corporate Income TaxShort Course in Current and Deferred Tax

R3 950

Read More about a Short Course in Current and Deferred TaxShort Course in Taxation & Administration of Trusts

R2 950

Read More about a Short Course in Taxation & Administration of TrustsShort Course in Estate Duty and Donations Tax

R2 950

Read More about a Short Course in Estate Duty and Donations TaxShort Course in Payroll Taxes and Processing

R1 950

Read More about a Short Course in Payroll Taxes and ProcessingShort Course in Basic Financial Accounting

R1 950

Read More about a Short Course in Basic Financial AccountingCertificate in Accounting (NQF 5)

Duration 12 Months

R41 475

Upcoming Live Events

SAGE: 2026 Annual Payroll Tax Update Webinar

3.5 Hours

|

09:00

Mar 6, 2026

Navigating SARS Administrative Fairness: Taxpayer Rights, Common Complaints, Emerging Trends and Practical Remedies

1 Hour

|

13:00

Mar 10, 2026

Busier Than Ever, But Where's the Profit? Billing, Pricing, and Cash Flow Strategies That Actually Work for SA Practices

2 Hours

|

15:00

Mar 12, 2026

Ethics and Risk in the Age of Generative AI: What Every Tax Accountant Must Know

2 Hours

|

15:00

Mar 16, 2026

Tax Dispute Resolution: RFC, NOO, and Appeals

2 Hours

|

15:00

Mar 17, 2026

Practical Guidance: How to Resolve VAT Issues in Practice

1 Hour

|

15:00

Mar 18, 2026

TaxCafe with Carmen Westermeyer: A Discussion Forum Resolving Practitioner Issues In Tax Practice - March 2026

2 Hours

|

09:00

Mar 20, 2026

Trust Compliance 2026: Navigating the SARS Enforcement Crackdown

2 Hours

|

15:00

Mar 24, 2026

Leveraging Alternative Dispute Resolution (ADR): A Procedural Guide to Settlements

1.5 Hours

|

15:00

Mar 25, 2026

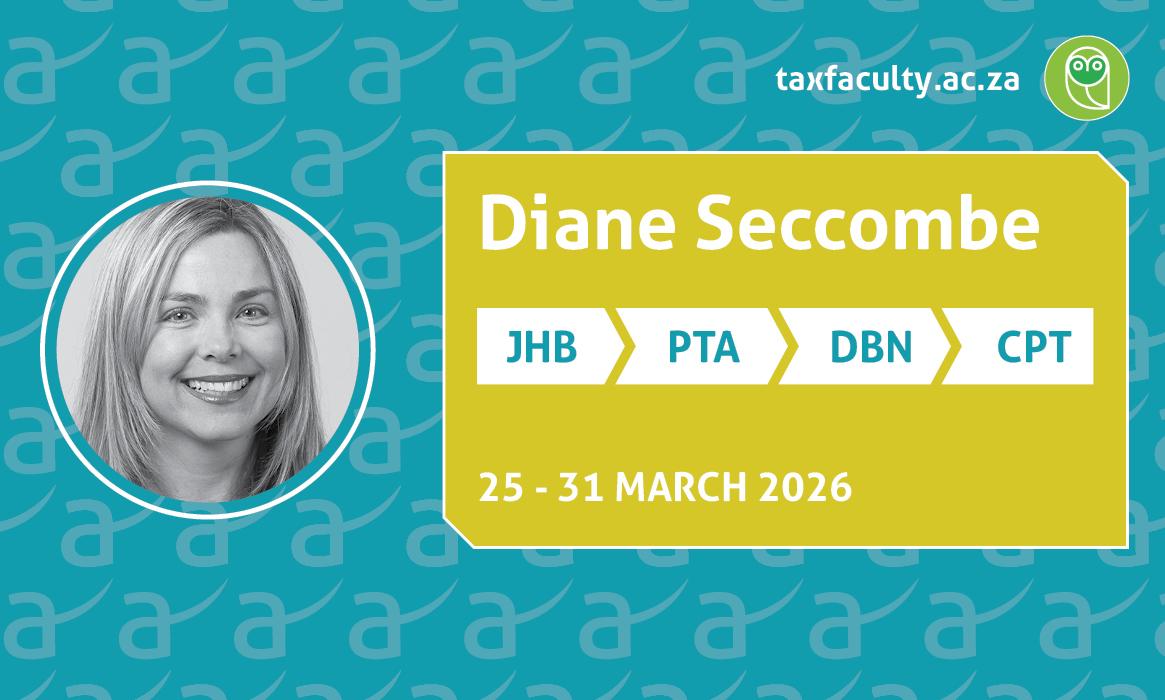

2026 Annual Budget and Tax Update

4 Hours

|

09:00

Mar 25, 2026

Objections That Work: Drafting Technical Objections That SARS Cannot Ignore

2 Hours

|

15:00

Apr 15, 2026

eFiling Clinic: How to Work Around System Issues - April 2026

1 Hour

|

15:00

Apr 16, 2026

TaxCafe with Carmen Westermeyer: A Discussion Forum Resolving Practitioner Issues In Tax Practice - April 2026

2 Hours

|

09:00

Apr 17, 2026

Tax Litigation: Applications on Notice

1.5 Hours

|

15:00

Apr 20, 2026

Monthly SARS Update with Prof Jackie Arendse - April 2026

2 Hours

|

15:00

Apr 23, 2026

Appeals, ADR and Strategy: Choosing the Right Dispute Path

2 Hours

|

15:00

May 13, 2026

Preparing for Tax Litigation: The Trial

1.5 Hours

|

15:00

May 18, 2026

Monthly SARS Update with Prof Jackie Arendse - May 2026

2 Hours

|

15:00

May 21, 2026

TaxCafe with Carmen Westermeyer: A Discussion Forum Resolving Practitioner Issues In Tax Practice - May 2026

2 Hours

|

09:00

May 22, 2026

eFiling Clinic: How to Work Around System Issues - June 2026

1 Hour

|

15:00

Jun 11, 2026

Monthly SARS Update with Prof Jackie Arendse - June 2026

2 Hours

|

15:00

Jun 18, 2026

TaxCafe with Carmen Westermeyer: A Discussion Forum Resolving Practitioner Issues In Tax Practice - June 2026

2 Hours

|

09:00

Jun 19, 2026

Tax Litigation: Navigating Cost Orders and Appeals

1.5 Hours

|

15:00

Jun 24, 2026

Monthly SARS Update with Prof Jackie Arendse - July 2026

2 Hours

|

15:00

Jul 23, 2026

TaxCafe with Carmen Westermeyer: A Discussion Forum Resolving Practitioner Issues In Tax Practice - July 2026

2 Hours

|

09:00

Jul 28, 2026

eFiling Clinic: How to Work Around System Issues - August 2026

1 Hour

|

15:00

Aug 13, 2026

Monthly SARS Update with Prof Jackie Arendse - August 2026

2 Hours

|

15:00

Aug 20, 2026

TaxCafe with Carmen Westermeyer: A Discussion Forum Resolving Practitioner Issues In Tax Practice - August 2026

2 Hours

|

09:00

Aug 21, 2026

Monthly SARS Update with Prof Jackie Arendse - September 2026

2 Hours

|

15:00

Sep 17, 2026

TaxCafe with Carmen Westermeyer: A Discussion Forum Resolving Practitioner Issues In Tax Practice - September 2026

2 Hours

|

09:00

Sep 18, 2026

eFiling Clinic: How to Work Around System Issues - October 2026

1 Hour

|

15:00

Oct 15, 2026

Monthly SARS Update with Prof Jackie Arendse - October 2026

2 Hours

|

15:00

Oct 22, 2026

TaxCafe with Carmen Westermeyer: A Discussion Forum Resolving Practitioner Issues In Tax Practice - October 2026

2 Hours

|

09:00

Oct 23, 2026

TaxCafe with Carmen Westermeyer: A Discussion Forum Resolving Practitioner Issues In Tax Practice - November 2026

2 Hours

|

09:00

Nov 20, 2026

Resources On-Demand

2026 National Budget: Tax Economical and Geopolitical Analysis

3 Hours | R146.00

Read More about a 2026 National Budget: Tax Economical and Geopolitical AnalysisStrategic Analysis of Management Statements in Business Advisory Practice

2 Hours | R195.00

Read More about a Strategic Analysis of Management Statements in Business Advisory PracticeTaxCafe with Carmen Westermeyer: A Discussion Forum Resolving Practitioner Issues In Tax Practice - February 2026

2 Hours | R195.00

Read More about a TaxCafe with Carmen Westermeyer: A Discussion Forum Resolving Practitioner Issues In Tax Practice - February 2026eFiling Clinic: How to Work Around System Issues

1 Hour | R99.00

Read More about a eFiling Clinic: How to Work Around System IssuesEscaping the SARS and CIPC Compliance Efficiency Trap

2 Hours | R195.00

Read More about a Escaping the SARS and CIPC Compliance Efficiency TrapSARS Diesel Refund Scheme Modernisation

1 Hour | R99.00

Read More about a SARS Diesel Refund Scheme ModernisationFundamentals of AI for Tax Accountants

1 Hour | R99.00

Read More about a Fundamentals of AI for Tax AccountantsAI for Tax Accountants; Beyond the Hype - Practical Use Cases

1 Hour | R99.00

Read More about a AI for Tax Accountants; Beyond the Hype - Practical Use CasesNavigating the Minefield of Provisional Tax in 2026

2 Hours | R195.00

Read More about a Navigating the Minefield of Provisional Tax in 2026Latest News

The Power of Continuous Tax Education for South African Tax Professionals

- 25 February 2026

- Individuals Tax

In the ever-evolving world of taxation, continuous education is crucial for accountants and tax prac...

Read More about a The Power of Continuous Tax Education for South African Tax ProfessionalsFrom Zero to Tax Hero: Understanding the Basics of Taxation for Beginner Tax Students

- 21 February 2026

- Individuals Tax

This guide will simplify taxation basics, equipping you with a strong foundation to confidently begi...

Read More about a From Zero to Tax Hero: Understanding the Basics of Taxation for Beginner Tax StudentsAre You Confident That You Will Survive a SARS VAT Audit?

- 16 February 2026

- VAT

A practical look at preparing for a SARS VAT audit, avoiding common pitfalls, and managing disputes...

Read More about a Are You Confident That You Will Survive a SARS VAT Audit?The Request for Reasons: A Critical Gateway in Tax Dispute Resolution under the Tax Administration Act

- 09 February 2026

- Tax Administration

Why the Request for Reasons matters in tax disputes — and how Rule 31(3) limits SARS during appeals.

Read More about a The Request for Reasons: A Critical Gateway in Tax Dispute Resolution under the Tax Administration ActWhy SARS and CIPC compliance still feels hard — and why It doesn’t have to?

- 06 February 2026

- Tax Administration

SARS and CIPC compliance doesn’t have to be reactive. This session explores how structured workflows...

Read More about a Why SARS and CIPC compliance still feels hard — and why It doesn’t have to?Mastering Tax Court Rules Before Litigation: Your Strategic Edge

- 05 February 2026

- Tax Administration

Turn compliance into strategy. Gain the knowledge that gives you—and your clients—the advantage.

Read More about a Mastering Tax Court Rules Before Litigation: Your Strategic EdgeVAT Apportionment in South Africa: A Practitioner's Guide to BGR 16 (Issue 3)

- 21 January 2026

- VAT

A comprehensive overview of the standard turnover-based method, exclusions, and adjustments under Bi...

Read More about a VAT Apportionment in South Africa: A Practitioner's Guide to BGR 16 (Issue 3)Provisional Tax: Practical Guidance to Avoid Penalties and Interest

- 14 January 2026

- Individuals Tax

This article unpacks provisional tax, who it applies to, and why reasonable estimates are key to avo...

Read More about a Provisional Tax: Practical Guidance to Avoid Penalties and InterestApportionment – A new dawn

- 11 December 2025

- VAT

This article outlines the key changes in VAT BGR 16 (Issue 3), including updated apportionment rules...

Read More about a Apportionment – A new dawnTop Tax Trends to Watch in 2026: A Guide for South African Tax Students

- 03 December 2025

- Blogs

This article is a guide for South African tax students and discusses the top tax trends to keep an e...

Read More about a Top Tax Trends to Watch in 2026: A Guide for South African Tax StudentsTestimonials

Occupational Qualification: Tax Technician

Edith Phumudzo Mlilo

Professional Certificate in Estate and Trust Administration

Slindile Ndlovu

Professional Certificate in Taxation of Individuals

Sophonia Matlabo

Professional Certificate in International Taxation

Nonophile Mabuza

Occupational Qualification: Tax Professional

Rameck Gadziso

Occupational Qualification: Tax Professional

Allister Kolobe

Occupational Qualification: Tax Professional

Theunis Begley

Professional Certificate in Taxation of Corporates

Sumaya Zairoodin

Occupational Qualification: Tax Professional

Brenda Ashford

Occupational Qualification: Tax Professional

Deryn Garz

Professional Certificate in Advanced Taxation

Jaco Duvenhage

Professional Certificate in Tax Advisory and Opinion Writing

Annika Swanepoel

Professional Certificate in Taxation of Individuals

Jaun-Mari Booysen

Occupational Qualification: Tax Professional

Lovemore Kufahakurambwi

Occupational Qualification: Tax Technician

Daniel Henriksen

Professional Certificate in Taxation

Nyaku Sony Maimela

After completing my Tax Technician qualification, I developed a strong desire to deepen my understanding of tax. To say that the course was challenging would be an understatement, given the demands of balancing work, family, and study...

Liezel Govender

TTF's Occupational Qualification: Tax Professional exceeded all expectations. Their bursary grant provided everything needed for success, from textbooks and laptops to online webinars, study resources, and mental health tools...

Sankie Nkosi

I now listen to The Tax Faculty's webinar recordings on my way to and from work. I'm no longer bothered by the traffic and can use my travel time productively. Thank you!

Lawrence Maqekoane

Applying for the Occupational Certificate: Tax Professional bursary truly changed my life. Having prior tax knowledge and completing my H Dip Tax qualification in 2010, I initially thought this would be just the “refresher” course I needed...

Bernedette van der Walt

I appreciated the case study, which really brought everything to life for me and expanded my understanding. The in-depth pool of study resources made an invaluable difference. I can’t wait for my next course - I know I will emerge...

Nokukhanya Mthethwa

A key indicator of a great organisation is how quickly suggestions for improvement reach decision-makers. I experienced this first-hand when Stiaan Klue called me to discuss a suggestion I made to a frontline staff member. I was blown away...

Murray Bolton

Thanks to a fully funded bursary, I was able to do the Occupational Qualification: Tax Technician. I've transformed my passion for taxation into a career. The practical simulations and comprehensive learning materials have boosted my skills and...

Nafeesah Abrahams

I want to thank Silindile, my course consultant, for her continued support, excellent sales skills, and great customer service.

Shalin Munien

I feel that your courses are presented very well. They teach us exactly how things work in practice, with a very good understanding of how SARS operates. I like how it flows weekly with a video, study guide, reading work, and a quiz to test our knowledge.

Marisca de Bruyn

We were recently at a seminar in Somerset West where there weren’t enough chairs, and you helped bring in new chairs. Someone asked you, and you said that one can't be the CEO and then sit back when things need to be done...

Marisca de Bruyn

I contacted The Tax Faculty online regarding various courses and training, and Jennifer got back to me immediately with the relevant information. She has been nothing but amazing, consistent, informative, and very helpful...

Sarah Corlett

This course has been an eye-opener for me and has added so much value. It is literally the entire tax portfolio combined into one - tax on steroids! Personally, I have learned so much, shared my knowledge...

Carmen Botha

Thanks so much for making and publishing the "SARS Auto assessment: Requesting a correction or revised assessment after 40 days" YouTube video! Very helpful!

Explore Pro Tech

I want to express my gratitude for the invaluable assistance The Tax Faculty and especially my course consultant, Thato, have provided throughout the duration of the course. Your dedication and willingness to assist has been truly commendable...

Bongeka Ndebele

I completed the Professional Certificate in Accounting for Tax in Financial Statements at the end 2023. It is a brilliant course, and I really enjoyed it. Learned all the key skills for Tax reporting.

Arthur B.

What a pleasure to be part of the top 3 students of the Professional Certificate in Taxation 2023. The journey was not always easy and at the end with all the help from the facilitators it was possible to finish. Was indeed a great learning opportunity...

Lizzele Vermeulen

Just the very best CPD provider! Thanks to all at The Tax Faculty.

Sally Hansen

The Tax Faculty are absolutely amazing and I can personally recommend them. Apart from the brilliant study material they have fantastic lecturers and personnel who have consistently supported me over the past 4 years of my study journey with them!

Alida van der Vyver

Learning from The Tax Faculty was a fantastic choice for me. I'm so thankful for all they did to help me pass my EISA 2023 exam. Without the financial support they gave me, I wouldn't have been able to study, so I'm very grateful for that too...

Bernedette van der Walt

Your Tax Professional Course is one of the best courses that I have ever attended. With the quality of your teaching and study material, failing the EISA would have been a shame...

Joey Kasvosve

Thank you for the team at The Tax Faculty for being so helpful. The course material is of such high quality. Thank you!

Ulandi van As

The team at The Tax Faculty is top-notch. I will recommend this institution and its courses to everyone who is interested. Now we can all relax. Thank you team is top-notch. I will recommend this institution and its courses to everyone...

Ulandi van As

Thank you Janet from The Tax Faculty for being so considerate and helpful. The Tax Faculty has proven again that they are the best! The amount of support you guys have from Tax Practitioner's is magic.

Pieter van Staden

I passed my 1st assessment so well. Thank you Roelánnie from The Tax Faculty for fighting for those who passed at least one of the Diagnostic Tests in order to continue with the RPL and not the two-year program.

Yolisa Sisusa

I just want to say thank you to everybody at the Tax Faculty, I passed my exam as a Top Performer! Thank you for pushing me, and for your kindness and understanding with all my queries! I can’t thank you enough!

Clarissa van Heerden

Thanks to The Tax Faculty I passed my summative assessment (EISA) that I wrote in July. I would like to express my appreciation to the whole Tax Faculty team, the lecturers, and everyone who was involved in my learning process...

Juliet Mufuka

What an enjoyable encounter and decision! I can absolutely recommend any professional or student to consider The Tax Faculty as their go-to institution when they want to further their studies and knowledge regarding taxes in South Africa...

Ilse Garner

I feel the training is relevant and one of the few places that gives us affordable CPD training.

Elsabe Lubbe

The Tax Faculty webinars are simply the best!

MC Botha

The Tax Faculty has superior training consultants who are highly qualified and respected.

Lucille Kaspersen

The Tax Faculty offer top notch CPD training.

Tanya A Pitcher

The Tax Faculty's webinars are of great value and excellent standard. As a tax practitioner, I will always use them.

Santie van der Merwe

The CPD offered by The Tax Faculty are of high quality and so are the presenters.

Irene Forbes

Tax faculty webinars are excellent and definitely needed. It’s also always well prepared and addresses the point.

I Mouton

I want to express my gratitude to the Tax Faculty for their excellent management of the administrative tasks and for organising the course I attended in 2023 so well. I will definitely recommend The Tax Faculty to anyone thinking about becoming a student.

Dirk Jooste

I want to express my heartfelt gratitude for the exceptional assistance you have provided me. Your eloquence and profound knowledge have been truly impressive. But what touched me the most was your patience and your willingness to listen...

Tinashe Mutematsaka

The staff at tax faculty are incredibly helpful and resolve any issues with urgency when problems are encountered. The courses have been very informative with the different aspects to the learning material. Highly recommend.

Astrid Gaffney

I completed the income tax course and let me just say WOW. It helped to gain more knowledge and to get a good foundation. The case studies we worked through were a good way to apply the knowledge...

Pioneira Pelston

The Tax Faculty offers very interesting webinars where I can gather my CPD points. I already renewed my subscription for 2024.

Barbara Segalla

The Tax Faculty is the only CPD provider that provides me with affordable and relevant updates that keep me up to date on the areas that I work in. Their exceptional client services show that they are committed to providing affordable training...

Wanita van Zyl

The value that The Tax Faculty’s excellent, well-presented, and topical webinars bring, far outweighs just my CPD points. I feel it does add value to my work and knowledge. Let's renew my subscription!!

SJ Du Plooy

The Tax Faculty provides excellent webinars covering subjects like recent court cases which I would never have studied otherwise. There’s always something to learn. I have renewed my subscription.

Richard O’Callaghan

The Tax Faculty has consistently demonstrated a commitment to excellence in every aspect of their CPD offerings. From the quality of the courses and resources to the competence of their instructors and the user-friendly platform...

Nafisa

I would like to extend my heartfelt congratulations to The Tax Faculty for their exceptional work in curating the CPD program. The quality is truly outstanding. I find the content valuable that I make a point to listen to them...

Marina Fourie