CATEGORIES

- (47)Accounting & Financial Reporting

- (1)Accounting for Income Tax

- (1)Application of tax rates, s6(2) rebates

- (1)Assessed losses

- (10)Blogs

- (1)Business Advisory

- (8)Capital Gains Tax

- (1)Capital Gains Tax - Individuals Tax

- (1)Capital Gains Tax Implications of Trusts

- (2)Case study: Home office expense

- (1)Case study: Travel allowances

- (1)Company Formations

- (136)Corporate Tax

- (10)Customs and Excise

- (2)Deceased Estate

- (1)Deductions Pre-trade and prepaid expenses

- (1)Deregistration

- (2)Employer and Employee (PAYE and UIF Specific)

- (1)Estate Duty

- (1)Events / Webinars

- (11)Faculty News

- (2)Farming

- (168)Individuals Tax

- (1)Input - Customs Duty

- (3)Interest

- (18)International Tax

- (1)Nature of the rights of beneficiaries

- (1)Notional input tax

- (9)Payroll

- (2)Practical Payroll

- (2)Provisional tax (Link with other Taxes)

- (4)SARS Issues

- (156)Tax Administration

- (2)Tax Administration Part 2B: Resolving Problems with SARS using the Tax Ombud

- (1)Tax Administration Part 3B Dispute Resolution - Objection and appeal

- (3)Tax Dispute Resolution

- (1)Tax Opinions

- (3)Tax Update

- (1)Tax implications of loans to trusts

- (1)Tax residence

- (1)Tax returns and payments

- (3)Transfer-Pricing

- (1)Trust Income / Gain Allocations

- (1)Trust types and income allocations

- (10)Trusts

- (84)VAT

- (3)VAT periods

- (1)Wear and tear allowances

- (13)Wills, Estates & Succession

- (1)Zero Rated

- (2)eFiling

- Show All

SARS issues binding class ruling regarding unbundling transaction

- 06 May 2020

- Corporate Tax

- Tsanga Mukumba and Louis Botha

Friday, 21 June 2019

Important:

This article is based on tax law for the tax year ending 28 February 2020.

Authors: Tsanga Mukumba and Louis Botha (Cliffe Dekker Hofmeyr)

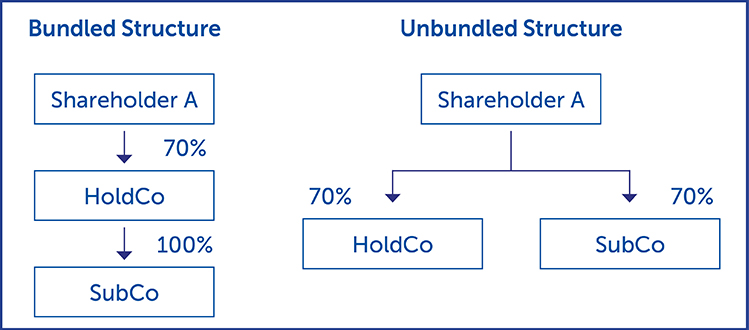

Section 46 of the Income Tax Act, No 58 of 1962 (Act) provides tax relief where a company (Unbundling Co) wishes to unbundle its shareholding in a subsidiary (Unbundled Co), to the company’s own shareholders. The Unbundling Co’s shareholders’ indirect shareholding in the Unbundled Co is converted to a direct shareholding, in proportion to their shareholding in the Unbundling Co.

Where an unbundling takes place outside the scope of s46 of the Act, as set out above, several tax consequences would ordinarily apply:

- Shareholder A would receive the shares in SubCo as a dividend in specie, which may result in liability for dividends tax under Part VIII of the Act;

- The disposal of the shares in SubCo, would constitute a disposal under the Eighth Schedule to the Act, potentially leading to a capital gain for HoldCo; and

- Securities transfer tax (STT) would be payable on the transfer of all the shares under the Securities Transfer Tax Act, No 25 of 2007.

On 24 May 2019, the South African Revenue Service (SARS) published Binding Class Ruling 066 (BCR 066). BCR 066 provides the income tax consequences and applicability of s46 to the receipt of shares in a listed company by resident and non-resident shareholders, following an unbundling of that company by its listed parent company. It is binding only on the parties to the ruling.

- The ruling dealt, among other things, with the following aspects of s46:

- The definition of “unbundling transaction” in s46(1)(a); and

- The anti-avoidance provisions in s46(3)(a)(v).

Please click here to read more.

This article first appeared on cliffedekkerhofmeyr.com.